Mastering the ESG Challenge with K-Lab

August 11, 2022. Currently, several environmental, social, and corporate governance (ESG) interconnected regulations lead with implementation deadlines within a short period. In this article, we explain why regulatory compliance, sophisticated data integration, and holistic, long-term IT solutions are no longer optional but significant and how K-Lab can support mastering these challenges.

A brief Introduction to ESG

The attention to sustainability constantly increases, leading regulators to define new regulatory frameworks, which also pose a significant challenge for banks. Environmental, social, and corporate governance (ESG) is an approach to evaluating companies that goes beyond maximizing profits on behalf of the corporation's shareholders and socially conscious investors. Given are a set of standards, the so-called ESG criteria, which are verifiable measures. To facilitate the widespread adoption of these ESG criteria, different regulators, in particular from the EU and USA, are defining, implementing, and monitoring a complex set of regulations.

The EU Commission defined a dedicated set on top of the Markets in Financial Instruments Directive II (MiFID II) framework. These regulations request financial market participants to:

- Collect client preferences on ESG

- Classify assets/issuers for ESG framework

- Advise to the client's compatible assets, only

- Create detailed reporting to Sustainable Finance Disclosure Regulation (SFDR).

From an operational perspective, it seems just a minor enhancement to the current MiFID solution. The reality is much different. The ESG approach requires a new mindset based on new types of non-financial data that must be interpreted with new business competencies to provide relevant information. All this, mixed with huge time pressure, brings banks, market data providers, and all stakeholders to an uncomfortable zone where decisions must often be taken without knowing the whole picture.

Additionally, it should be mentioned that adopting the ESG approach is beneficial for banks not only for advisory business but also to manage market risks better. The hurdles are to be ready soon with a robust, future-proof solution to gain a competitive advantage in a challenging market.

K-Lab ESG Value Proposition

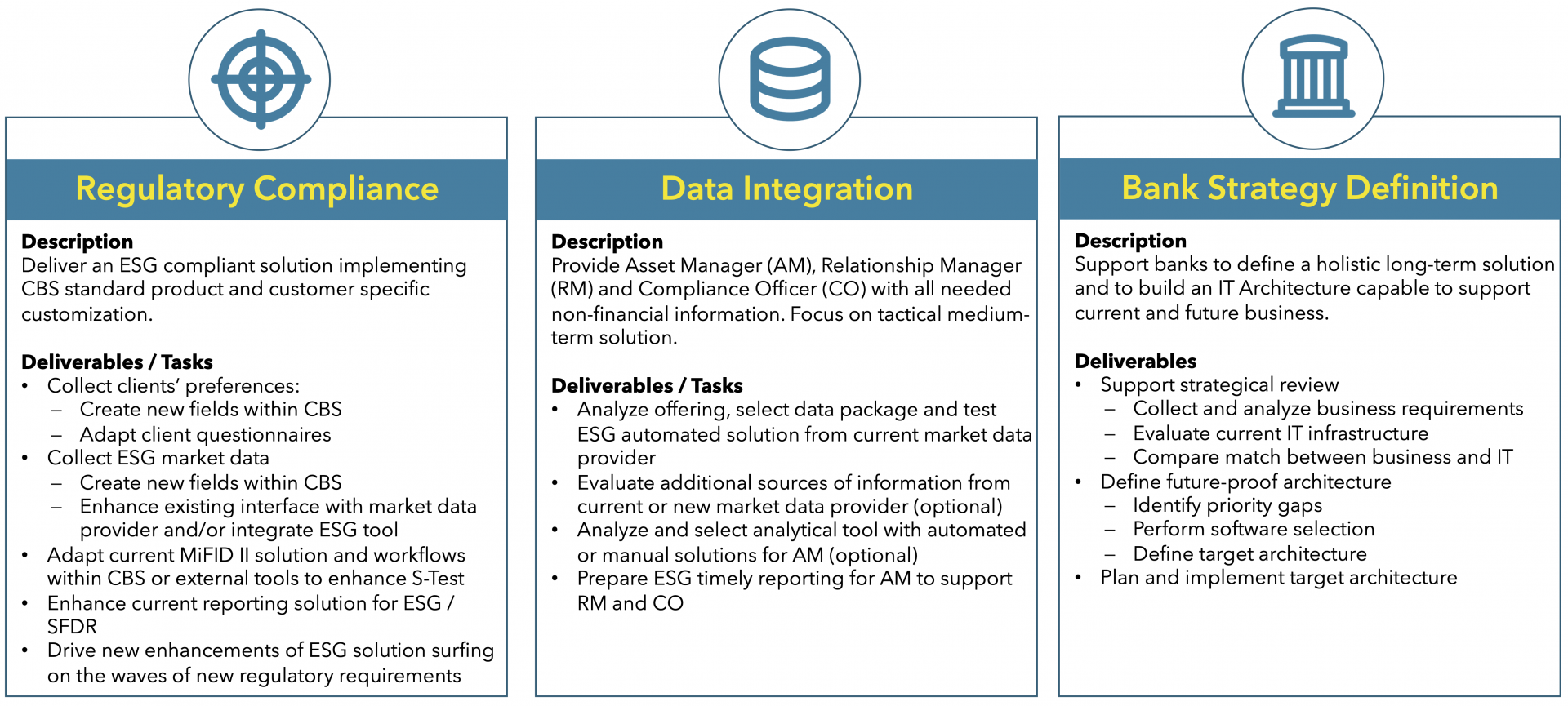

Knowledge Lab has an interdisciplinary team with extensive experience in Core Banking Systems (CBS) and Customer Application Landscape. It consists of experienced solution architects, integration specialists, and software engineers capable of facing the full scope of ESG projects. Specifically, K-Lab's ESG value proposition focuses on the following three fields:

- Regulatory Compliance

- Data Integration

- Bank Strategy Definition

The following figure summarizes these three fields of activity and their description with the respective deliverables and tasks.

Bank Strategy Definition

Starting from the last item in the figure above, we suggest reviewing the overall bank IT architecture periodically (every 3 to 5 years) to anticipate and drive future needs instead of suffering from market/regulator's events.

Data Integration

Recent studies from KPMG, State Street Global Advisors, and other leading market players report data quality hurdles, low correlation between the data of the different data providers, and a lack of transparency on how data are analyzed. Hence, data integration is the tough part of the ESG approach adoption. As an indication, each bank must decide:

- which providers to trust

- which data to use

- how/where to create/get relevant information for decision making

- which data make available to each bank user profile.

Any decision, taken or postponed, may impact the bank's competitiveness.

Regulatory Compliance

Regulatory compliance is the most standard activity once data integration and IT architecture are defined. As for any MiFID II enhancement, it's a matter of carefully implementing the framework, mapping the required data from the sources and the architecture defined in the previous sections.

Facing the ESG Challenge holistically

Suppose you wish to face the ESG challenge holistically with a long-term IT-solution. In that case, K-Lab's Solution Architects and Business Experts will, as a matter of course, support you in the strategic review and defining a robust and flexible future-proof solution for expected or unexpected changes. Our Software Developers are then ready to deliver the solution smoothly.

Thanks to Fabio Perletti, Michael Steiner, Matthieu Bray, and Dario Bonaconsa.

For more details on the ESG challenge, main EU ESG regulations, regulatory timeline, legal requirements, and further information, we refer to the whitepaper The ESG Challenge - For Compliance and successful Investing.

For further information and services please contact Fabio Perletti or Michael Steiner.

.png)

.png)