We support you in understanding the regulations, the opportunities, in selecting which one to implement if you are a Swiss bank and how to transform its challenges into opportunities.

Digital Wealth Management under MiFID II / FinSA

Goal

On 1st of January 2020 the Swiss regulations of FinSA as well as the related ordinance FinSO became enforceable in Switzerland which shall serve as a legal basis for investor protection follows the principle of same business, same rules, with the goal to reach equivalence with respective EU regulations under MiFID II, however under Swiss law deviating in certain aspects from the ones applicable to clients under EU laws and regulations.

Insight & Action

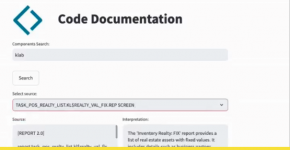

Knowledge lab analyzed both MiFID II and FinSA and provides guidance on understanding the impact of client classification, client opting-in/out, the service model (discretionary, advisory, exec only) and if advice is given portfolio-based. Comparing this impact between both regulations, based on the implications on general, business and product specific information duty, appropriateness and suitability assessment, ex-ante cost transparency and target market checks, allows for optimized implementation decisions.

Results

The implementation decisions provide the basis for digitization and optimization of service efficiency. Starting with the client opening and profiling, the automatic derivation of investment strategies and restrictions up to the fully automated evaluation of the A- and S- test, the information duty and the target market check, the receipt of information documents, the automatic documentation and generation of trading instructions. Efficient, effective and compliant.

.png)

.png)